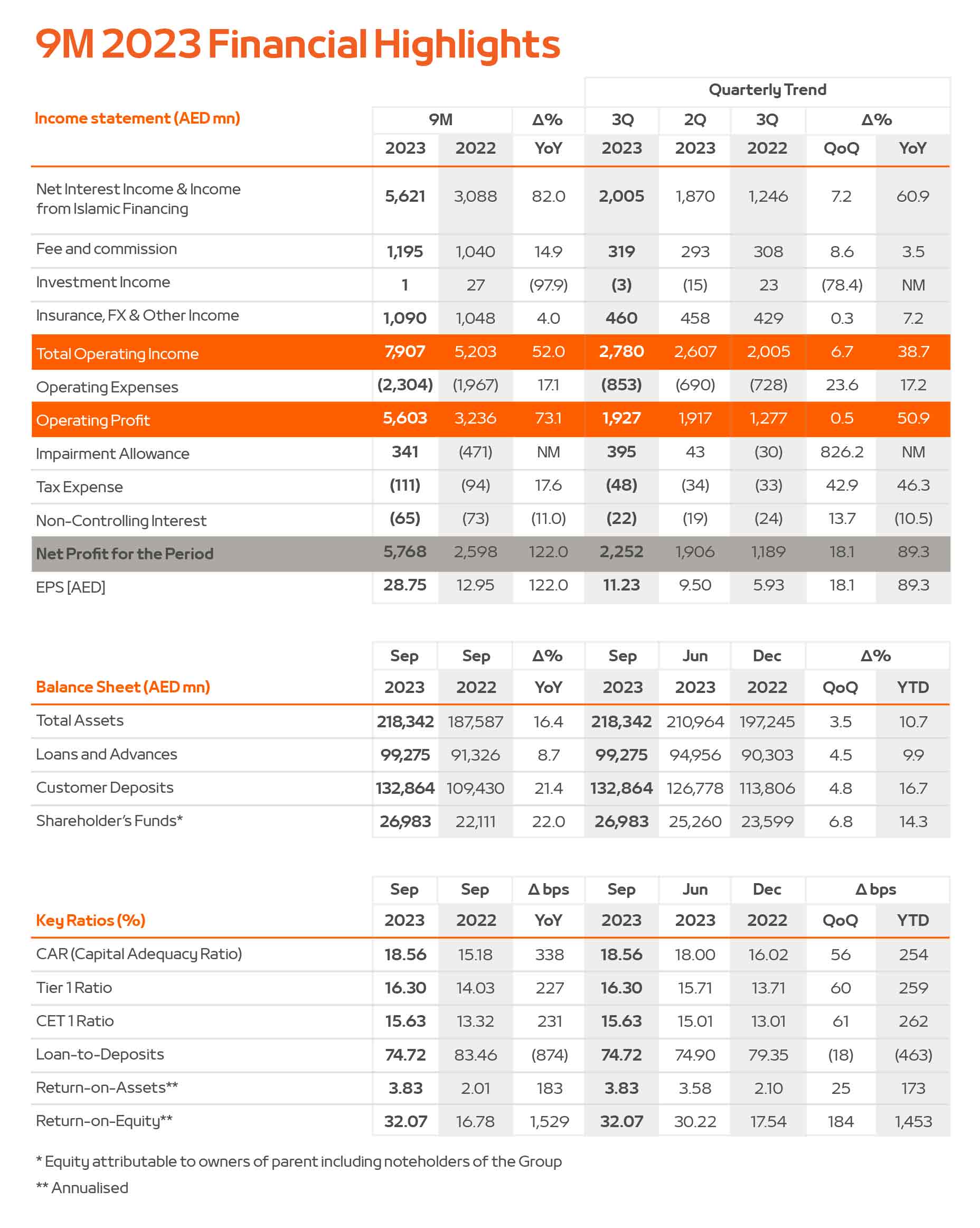

Dubai, UAE: Mashreq announces its financial results for 9M 2023 continuing its strong sustainable growth trajectory and enhancing shareholder value with an Earnings per Share of AED 28.75.

- Net interest income surges by 82%, benefiting from balance sheet growth, healthy client margins, while non-interest income shows a strong increase of 8.1% year on year.

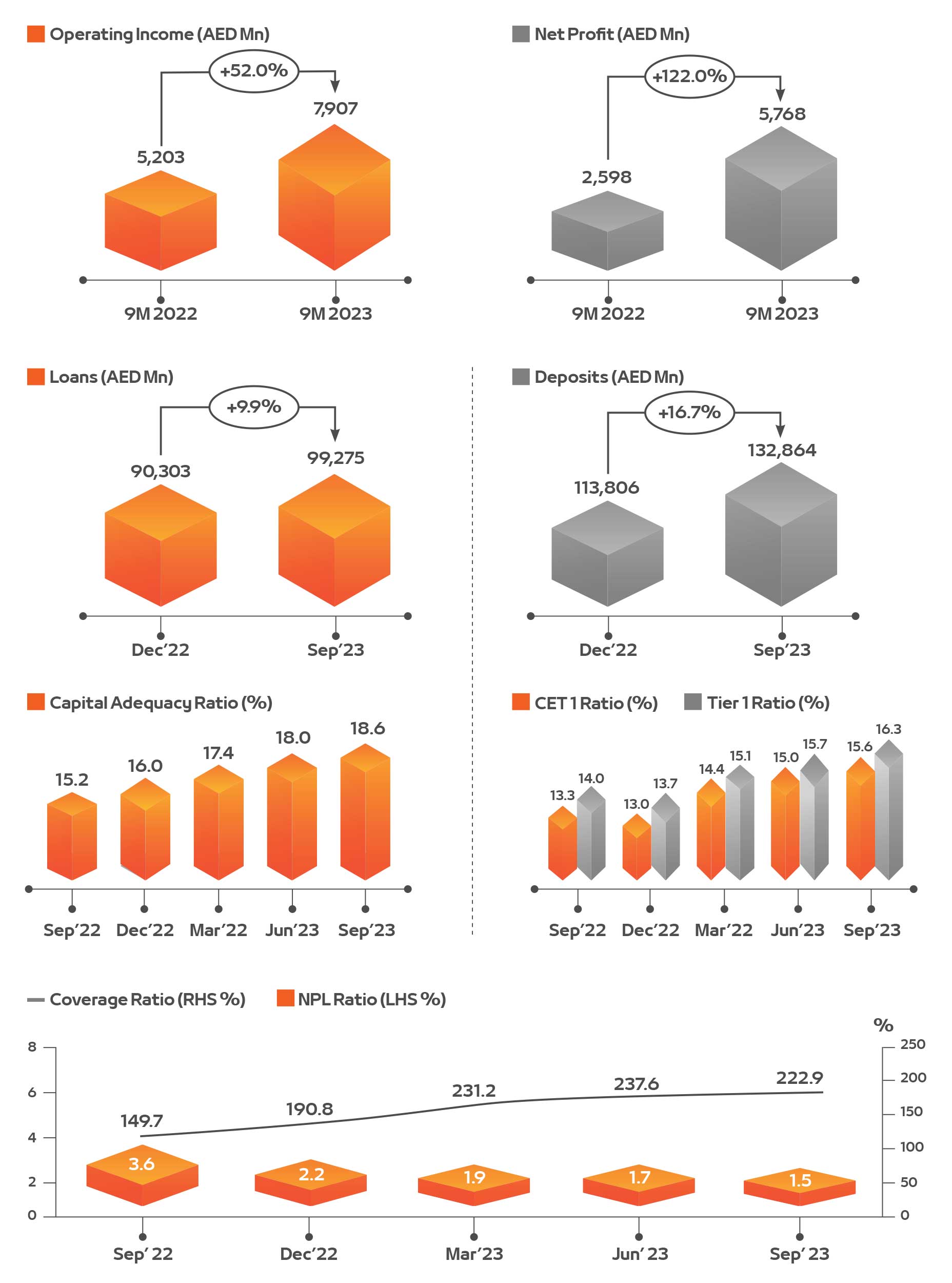

- Balance sheet growth is fuelled by Loans and Advances growth (9.9% year to date) and customer deposits growth (16.7% year to date).

- Capital adequacy ratio of 18.6% reaffirms robust capital position in a dynamic market, while ROE increases to 32.1%.

Key Highlights:

- Operating Income & Net Profit

- The increase in operating income and net profit is primarily attributed to a significant 82% increase in net interest income. This growth is a result of several factors, including the expansion of our balance sheet, healthy client margins, and the prevailing high-interest rate environment. Additionally, our non-interest income has reached AED 2.3 billion, marking a notable 8.1% year-on-year growth in 9M 2023.

- The bank has demonstrated a positive jaws ratio of 34.8% in 9M 2023, and the Cost-Income ratio has improved by over 8% year-on-year. This indicates effective control over operating costs while enabling continued investments in enhancing our client experience, risk management and supporting business growth.

- Operating profit has surged from AED 3.2 billion to AED 5.6 billion in 9M 2023, representing a remarkable 73% increase compared to the same period in 2022.

- The allowance for impairments has experienced a net release of AED 341 million, driven by a decrease of 69% year-on-year in low-risk charges, amounting to AED 244 million.

- Mashreq’s Net Profit has soared to AED 5.8 billion for 9M 2023, a substantial increase of 122% year-on-year. This performance is attributed to our successful growth strategy, commitment to customer excellence, strong operating performance, efficient cost management, and prudent risk management capabilities.

- Return on Equity (ROE) at record-high of 32.1% in 9M 2023, doubling compared to 9M 2022.

- Liquidity & Capital position

- High Liquidity denoted by a Liquid Assets ratio of 32.3% and an efficient Liquidity Coverage Ratio of 126.6% as of September 2023

- Capitalization level remains robust with the Capital adequacy ratio at 18.6%, Tier 1 Capital ratio at 16.3% and CET1 ratio at 15.6% as of September 2023

- Credit Environment & Asset Quality

- Overall loan portfolio quality has improved significantly with gross impairments to gross assets at just 0.2% (0.8% in 9M 2022)

- The Non-Performing Loans to Gross Loans ratio declined to 1.5% as of end of September 2023 (2.2% as of December 2022) and is one of the lowest in the market.

- Total provision for loans and advances reduced to AED 4.0 billion in September 2023 from AED 4.8 billion in December 2022 and coverage ratio improved to 222.9% as on 30th September 2023 (190.8% in December 2022)

| 122% YoY Net Profit Growth |

5.8 billion Net profit (AED) |

18.6% Capital adequacy ratio |

|||

| 73.1% Operating Profit Growth |

9.9% YTD Loans Growth |

1.5% NPL gross loans ratio |

|||

| 32.1% Return on equity |

3.8% Return on assets |

29.1% Cost to Income Ratio |

|||

| 16.7% YTD Customer Deposits Growth (CASA 63%) |

|||||

H.E AbdulAziz Al Ghurair, Chairman of Mashreq:

“The UAE banking sector continues to demonstrate remarkable resilience and growth, laying a strong foundation for the entire financial landscape of the country. Our recent achievement, a remarkable 122% year-on-year surge in net profits, stands as a testament to Mashreq’s enduring strengths and forward momentum. However, our vision extends beyond numbers. At Mashreq, we are firm in spearheading the region’s sustainability journey by offering tailored financial solutions that catalyse the transition to a greener economy, paving the way for the UAE’s goal of Net Zero by 2050. Through our association with COP28, we reiterate our dedication to combating climate change and championing a sustainable tomorrow. It is a time of reinvention, of looking ahead, and ensuring that as leaders in the banking industry, we not only drive profits but also champion the cause of a sustainable future for all.”

H.E AbdulAziz Al Ghurair, Chairman of Mashreq:

“The UAE banking sector continues to demonstrate remarkable resilience and growth, laying a strong foundation for the entire financial landscape of the country. Our recent achievement, a remarkable 122% year-on-year surge in net profits, stands as a testament to Mashreq’s enduring strengths and forward momentum. However, our vision extends beyond numbers. At Mashreq, we are firm in spearheading the region’s sustainability journey by offering tailored financial solutions that catalyse the transition to a greener economy, paving the way for the UAE’s goal of Net Zero by 2050. Through our association with COP28, we reiterate our dedication to combating climate change and championing a sustainable tomorrow. It is a time of reinvention, of looking ahead, and ensuring that as leaders in the banking industry, we not only drive profits but also champion the cause of a sustainable future for all.”

Ahmed Abdelaal, Group Chief Executive Officer, Mashreq:

“Mashreq’s remarkable financial performance this year is a clear reflection of our relentless commitment to innovation and putting our customers first. The significant growth in net profit to AED 5.8 billion in the third quarter, spurred by an 82% increase in net interest income, underlines our strength and adaptability in an ever-changing financial landscape. Internationally, we continued to see the benefits of our diversified business model and strong balance sheet growth and our digital strides in Pakistan and licensing in Oman usher in a new era of exciting global growth. Our digital transformation continues to gain momentum with strategic partnerships with the likes of Alipay through NeoPay, enhancing our position in the digital banking revolution.

However, our commitments extend beyond business. Through our alliance with the Science-Based Targets Initiative (SBTi), we are expanding our environmental responsibility, solidifying our position at the frontline of industry sustainability, and underlining our pledge to a Net-Zero future.

Looking ahead, our strategy is multifaceted. Beyond financial investment, we aim to elevate the customer experience, fortify our security measures with cutting-edge fraud prevention, and optimize operations through automation. We are enthusiastic about amplifying our digital capabilities, especially by harnessing AI and nurturing flagship digital platforms like Neo and NeoBiz. Our journey has been commendable, but our vision remains expansive, awaiting the countless possibilities the future holds.”

Ahmed Abdelaal, Group Chief Executive Officer, Mashreq:

“Mashreq’s remarkable financial performance this year is a clear reflection of our relentless commitment to innovation and putting our customers first. The significant growth in net profit to AED 5.8 billion in the third quarter, spurred by an 82% increase in net interest income, underlines our strength and adaptability in an ever-changing financial landscape. Internationally, we continued to see the benefits of our diversified business model and strong balance sheet growth and our digital strides in Pakistan and licensing in Oman usher in a new era of exciting global growth. Our digital transformation continues to gain momentum with strategic partnerships with the likes of Alipay through NeoPay, enhancing our position in the digital banking revolution.

However, our commitments extend beyond business. Through our alliance with the Science-Based Targets Initiative (SBTi), we are expanding our environmental responsibility, solidifying our position at the frontline of industry sustainability, and underlining our pledge to a Net-Zero future.

Looking ahead, our strategy is multifaceted. Beyond financial investment, we aim to elevate the customer experience, fortify our security measures with cutting-edge fraud prevention, and optimize operations through automation. We are enthusiastic about amplifying our digital capabilities, especially by harnessing AI and nurturing flagship digital platforms like Neo and NeoBiz. Our journey has been commendable, but our vision remains expansive, awaiting the countless possibilities the future holds.”

Exhibits:

9M 2023 Awards:

Click HereUAE

Financials